Introduction

Understanding the fundamentals of dental insurance can empower you to take control of both your oral health and your budget. Whether you’re considering affordable dental insurance for yourself or your family, having the right information ensures you make wise decisions about coverage, providers, and potential costs. Dental insurance isn’t just about paying for routine care—it’s a tool to help prevent larger, costlier dental issues down the road.

Dental plans can be confusing at first glance, often leaving consumers wondering what is covered, how much they’ll pay out-of-pocket, and which services best fit their lifestyle and needs. By knowing the basics, you’ll be better equipped to choose coverage that aligns with your budget and promotes long-term oral health for you and your loved ones.

An effective dental insurance policy can safeguard you against large, unexpected dental bills and encourage you to prioritize preventive care. Most Americans will require some level of dental work in their lives, and insurance can protect not only your teeth but also your financial well-being. Comparing plans and knowing what to look for will help you maximize your investment in dental insurance.

Before selecting a plan, it’s important to recognize key features such as coverage categories, annual maximums, and network providers. With this foundation, you’ll be ready to navigate your options and select coverage that works for your unique situation.

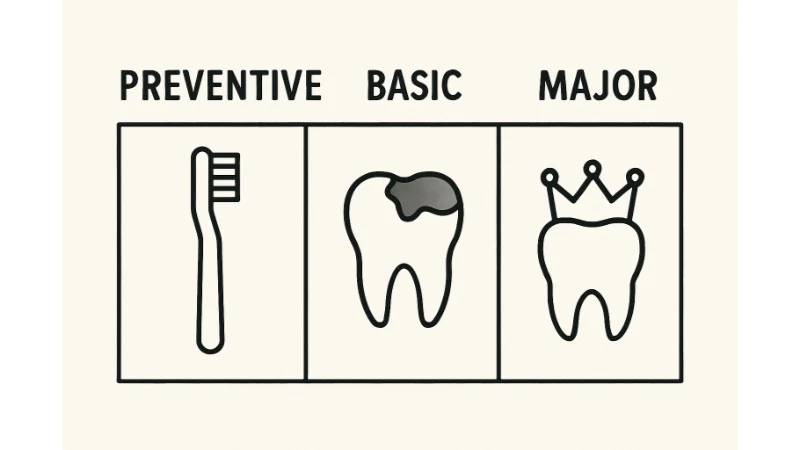

Understanding Coverage Categories

Dental insurance divides covered procedures into three main categories to simplify cost sharing and clarify benefits:

- Preventive and Diagnostic Care:Includes check-ups, cleanings, and X-rays. These services are frequently covered at 100%, encouraging annual or semiannual visits to monitor oral health and prevent larger issues. Skipping preventive care can lead to unnecessary pain and expense, so insurers incentivize routine visits.

- Basic Restorative Services:Treats common dental issues like cavities (fillings) and basic extractions, often covered at 70-80%. These services restore health when minor dental problems arise, helping prevent more complicated—and expensive—future procedures.

- Major Restorative Procedures:Includes crowns, bridges, root canals, and dentures. Usually covered at a rate of 50% or less, these are complex, higher-cost treatments. Being aware of your plan’s major restorative coverage is vital if you expect to need this type of care.

Knowing how your insurance classifies each service helps you anticipate costs and plan your care over the policy year. For more details on how these categories affect costs, consult resources like the American Dental Association.

Limitations on Cosmetic Procedures

Standard dental insurance rarely pays for cosmetic treatments, such as teeth whitening, bonding, or veneers. Orthodontic benefits are often available for children under family plans but tend to be excluded for adults unless you purchase specialized or supplemental insurance. If you’re interested in cosmetic services, carefully review your policy—some plans may offer discounts rather than full coverage, or you may need to seek alternative financing. For further guidance on common policy exclusions, Consumer Reports provides a helpful overview.

In-Network vs. Out-of-Network Providers

Enrolling with an in-network dentist can dramatically reduce your costs, as insurance companies negotiate rates with these providers. Out-of-network dentists, however, may bill you for the difference between their fees and your insurer’s reimbursement—potentially leaving you with higher out-of-pocket costs. Always search your insurer’s provider directory before scheduling an appointment to confirm network status and keep your dental expenses predictable.

Importance of Preventive Care

Routine dental exams and cleanings are critical—most insurance plans cover them fully to reinforce their value. Preventive care not only helps avoid cavities and gum disease but also makes it easier to detect illnesses (like oral cancer) early. Establishing a regular dental care schedule is foundational to both your oral and overall health.

Evaluating the Cost-Benefit of Dental Insurance

Buying dental insurance isn’t always a one-size-fits-all decision. Consider your oral health history, your anticipated need for dental work, and your financial goals. If you routinely require fillings, crowns, or other restorations, insurance can offer substantial savings. However, if your dental needs are light, compare what you’d pay in premiums versus paying for preventive visits out-of-pocket—it may be more cost-effective to self-insure.

Alternative Options: Dental Savings Plans

If traditional insurance doesn’t suit your needs, dental savings plans (often called dental discount programs) can help. These programs provide access to a network of dentists who offer their services at discounted rates, and there’s typically no annual maximum or complex paperwork. Dental savings plans can be a smart choice for those who need certain types of care right away or who don’t want to worry about claim denials or caps.

With a solid grasp of dental insurance basics and awareness of alternatives, you can make confident decisions that protect your oral health and your finances for the long run. Visit my blog for further details.